Are tech layoffs the canary within the US jobs market?

Tech Companies Reduce Workforce Despite Consistent Work Progress

Tech Companies Reduce Workforce Despite Consistent Work Progress

As it prepares for a potential recession, the tech industry is letting go of workers at an alarming rate, which is increasing concerns that widespread job losses could affect the whole US economy. Large Tech is pulling in closer despite strong job growth and high salaries across several industries in the face of a bleak financial future for the company.

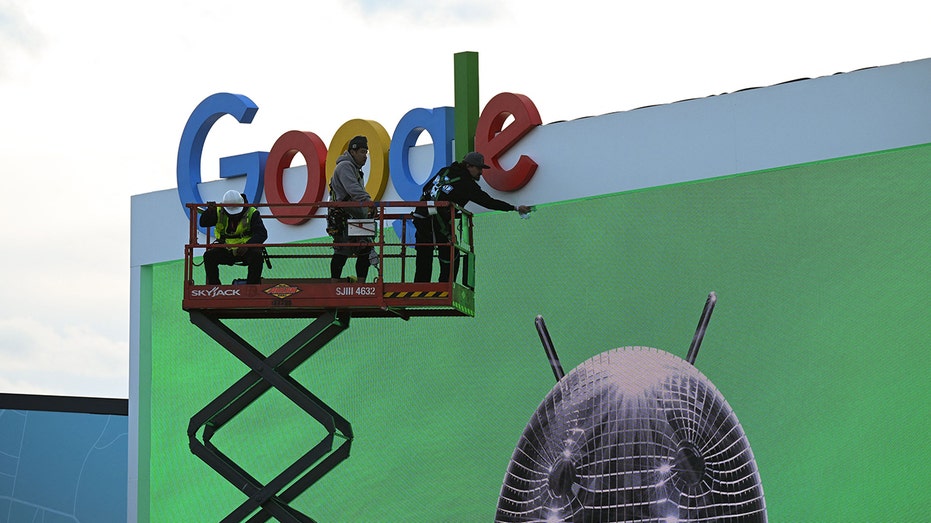

Alphabet Inc., the parent company of Google, announced on Friday that it intends to eliminate 12,000 jobs, or around 6% of its workforce, making it the latest technology company to reduce its employment. It amounts to one of the largest rounds of layoffs ever announced by the company and adds to the tens of thousands of job cuts that Microsoft, Amazon, Twitter, Salesforce, and Facebook parent company Meta have previously announced.

Since the beginning of 2022, expertise companies have eliminated almost 190,000 jobs, according to Layoffs.fyi, a website that keeps track of employment losses in the industry. According to consultants, the job losses appear to be a sign of upcoming layoffs across a variety of businesses in the labour market.

CEO of RSM Joe Brusuelas told FOX Enterprise, “This can be a foreshadowing of what’s prone to happen later this 12 months all through the economic system.”

He said the computer industry’s layoffs are the outcome of a phenomenon known as “labour hoarding,” whereby demand for workers is extremely high and unemployment is almost at a 50-year low.

Tech companies are right-sizing and trying to correct their over-hiring during the COVID-19 pandemic as a result of the Federal Reserve raising interest rates, reducing inflation, and slowing down consumer spending.

Concerning the state of the labour market, the December jobs report included several concerning indicators, such as the fifth consecutive month-to-month decrease in the number of temporary workers and the second consecutive month of a decrease in the number of overtime hours worked by employees.

Fed officials have stated unequivocally that they expect unemployment to rise as a result of higher fees, which may encourage consumers and businesses to reduce their spending once more. Current estimates from the December assembly of the central bank show that officials expect unemployment to increase from the current rate of 3.5% to 4.5% by the end of the next year. That might mean that, by the end of 2023, almost a million people will have lost their jobs.

According to Kelly: “Finally, the opposite factor to remember, is that the Fed actually shouldn’t be involved about individuals retaining their jobs.”

Reaching Stabilisation of Costs with Minimal Effect on Employment

Some see it as a tool to help them reach their goals, which include cost stabilisation and maintaining employee roles.